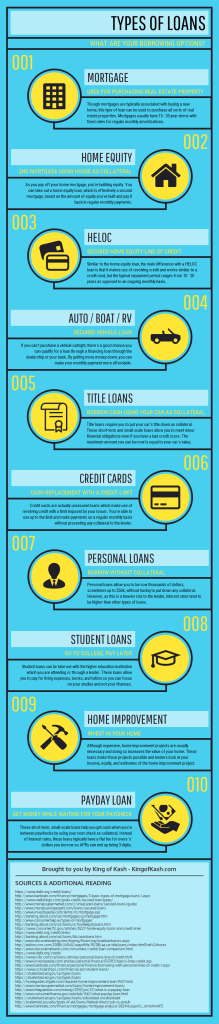

Types of Loans: Your Borrowing Options

Whether you want to buy a new car, purchase a home, buy jewelry for your significant other, or afford higher education you may need to take out a loan. Loans have consciously and unconsciously seeped into our-modern day spending – from big-ticket ones like mortgages and home equity loans to short-term loans like payday loans and revolving loans with the use of credit cards. Loans have made it possible to purchase items that you couldn’t otherwise pay for in cold hard cash.

There are different types of loans to cater to different financial circumstances of the borrower. Choosing the best type of loan for your needs and circumstances helps you keep your financial house manageable and in order.

Types of Loans

Secured Loans

Secured loans are loans that require collateral, which is generally a property or asset coming from the borrower. Secured loans allow borrowers to borrow a bigger loan amount than unsecured loans while following a lengthier repayment period. Most of the collateral accepted for secured loans are homes, CD / savings accounts, and vehicles. Most lenders use said collateral as a form of security in order to recoup their money should you default on the loan.Types of Secured Loans

Mortgage

Mortgages are the type of loans you use in purchasing a real estate property, such as a new home. In fact, mortgage is a term popularly used to refer to a loan home. Mortgage loans makes it possible for future homeowners to purchase a home with just a down payment while borrowing the rest of the amount from a bank or other lenders.

Mortgages work by allowing you to buy a home, but should you default on the loan, the bank is allowed to seize, foreclose, and auction the home to cover the costs of buying the property. In short, the home automatically becomes the collateral for this type of loan.

Home Equity

The home equity loan is also commonly referred to as the second mortgage. After having built enough equity on your first mortgage, you can take another loan, called a home equity loan, and use your home as collateral. You then pay back the loan through fixed monthly installments. The home equity loan is also a long-term borrowing commitment wherein the lender gives you the lump sum of the loan. After which, you can spend the amount in any way you wish.

Line of Credit

The secured line of credit, also known as home equity line of credit (HELOC) is an open-ended secured type of loan. Similar to the home equity loan, HELOC also uses the home as collateral (and as such, HELOC is also referred as second mortgage). However, the main difference is that HELOC makes use of revolving credit and works in similar fashion as credit cards.

The appeal in a secured line of credit is that you can use up the funds whenever the need arises and pay the amount owed on a monthly basis. HELOC applies a spending limit or maximum spending amount which must be paid back in a set term. The interests can vary depending on market conditions, but you are obliged to pay the loan back in full as you approach the end of the loan’s term.

Auto / Boat / RV Loan

If you can’t purchase a vehicle outright with your own money, there’s a good chance that you can get a loan through a financing program by your lender or the dealership where you intend to get it from. Through this method, you can easily acquire a new car, boat, motorcycle, or an RV.

The loans for auto, boat, and RV work pretty much the same way. Usually, the easiest way to finance these vehicles is by getting them from a dealership or getting your bank to finance its purchase.

Like other secured loans, it must be understood that the vehicle automatically becomes the collateral of the loan and it could be seized by the lender if you default the loan.

Title Loan

Title loans are secured loans that allow you to borrow cash by using your car’s title as collateral. Title loans can be great funding sources if you have bad credit score and don’t have access to other traditional types of loans. Title loans provide short-term and small scale loans designed to help you meet minor financial problems.

Unsecured Loans

Unsecured loans are loans that do not rely on collateral to gain approval. Instead, lenders rely on credit history and the borrower’s financial capacity to pay the loan back in deciding whether you are eligible for the loan or not.

Unsecured loans typically have higher interest rates than secured loans because lenders have no form of security (collateral) to depend upon. Furthermore, there are greater risks involved in lending without collateral and higher interest rates are imposed to help offset these risks.

Types of Unsecured Loans

Credit cards

Credit cards are the most popular financing tool in today’s day and age. It serves as cash replacement where the issuer gives you a credit limit, an interest rate, and a grace period. You can basically borrow money and use your credit card for just about everything– from purchasing online and in-store, getting plane tickets, paying for gas for your car, or booking your favorite restaurant.

Credit cards provide you with revolving funds. When you charge something on the card, you need to pay it off along with the interest at the end of the month. If you are unable to pay the whole balance off before the due date, the lender will apply interest on your account and it will accrue as long as you still have a remaining balance.

Personal Loans

Unsecured personal loans allow you to borrow a couple of thousand dollars, sometimes up to $50,000, without having to present collateral to your lender. While this can be less risky for borrowers as they don’t have to fear of losing their assets due to defaulting, though the risks can be heavy on the lenders. For this reason, personal loans tend to have higher interest rates than other loan types.

Personal loans can have both fixed and variable interest rates although fixed interest personal loans tend to be more popular nowadays. Most lenders impose a minimum loan amount, usually starting at $3,000 to maximum loan amount of around $50,000. It provides a bigger fund resource than credit cards, but interests tend to be high as well with some lenders starting at 13%. Loan terms for personal loans can run from 1 to 7 years.

Personal Lines of Credit

A personal line of credit provides a source of revolving fund without having to put up collateral to your lender. A personal line of credit works as a close cousin of home equity line of credit, although with LOC, you do not need collateral to draw your funds. Lenders will typically have to look into your credit score and financial stability and decide whether to grant you the line of credit or not.

Like personal loans, you can use a personal line of credit for just about anything. You can use it to pay huge bills, handle financial emergencies, and consolidate your debts. And much like your credit card, you can use your line of credit whenever needed. Like payday loans, you can get a line of credit from banks and private lenders.

Student Loans

Student loans are loans granted to college students and students taking master and doctorate programs. These loans can cover the students living expenses while in school, tuition, books among others.

Student loans are divided into two main categories: the federal student loans which are granted by the US government and the private student loans which are offered by private lenders. At present time, student loans are dominantly federal.

Home Improvement Loans

Although expensive, home improvement projects are usually necessary. Homeowners don’t just enter a home renovation project to improve aesthetics but also to increase appeal and functionality of the home. Doing so also increases the value of your home whether you’re selling it immediately or sometime in the future.

Home improvement loans help make these projects possible. Although the purpose of the loan is to improve or repair parts of the home, it doesn’t use the home as security for the loan. As with most unsecured loans, lenders rely on your credit worthiness, your equity to your home, your income, and the estimates of the home improvement project in granting you the loan or not.

Payday Loan

A payday loan is a short-term small-scale loan designed to help you find monetary relief while waiting for your next paycheck. These loans can start at $100 going up to a few thousand dollars. Instead of interest rates, payday loans are typically charged with flat fees. For instance, a lender can charge you $25 for every $100 you borrow so that by due date, you owe him $125 in total. Compared to credit cards and other loan types, payday loan charges when translated into APRs can easily resemble a three-digit figure.

Recap

Loans have become indispensable financing tools to make a lot of things happen: from addressing small scale financial problems to allowing you to buy and finance big-ticket items like your home and car.

Loans come in different forms and sizes, different amounts and interests, and with various repayment plans. When you take on any type of loan, you are also assuming the responsibility of paying it back, so take them seriously. Read the fine print of the loan, ask the lender questions, and familiarize all the details. Take into consideration how the loan can impact your financial life and ensure that its benefits will outweigh the risks. Being smart with the loans you take means you are being smart with your overall finances as well.

Cary Silverman is a consummate entrepreneur having sold multiple companies during his 20 years of business experience in the financial industry, but for him, it isn’t about the money. His success is rooted in his passion to focus on doing something better today than it was done yesterday. These days, he’s the CEO of Waldo General, Inc. that oversees the operation of King of Kash.

8 Comments

Thanks for pointing out that we should be responsible enough to read the fine print of the loan, inquire the lender, and be familiar with the details. I agree with that because it will show smart we are in handling our finances. Your reminders are very timely because we needed to take my mom’s jewelry to a pawnshop for a jewelry loan to help us finance the medical needs of my son who was diagnosed with asthma.

It really does help to know the different kinds of loans that are available from a pawnbroker, especially if you need the money for a certain thing. For example, if you’re just trying to get an engagement ring or something like that, you might just want to take out a personal loan. That way you’re not taking a serious loan out on something that isn’t massively important in the long run.

My sister is looking to take out a personal loan to fund her business. I had no idea a person could borrow as much as up to $50,000. It’s very interesting that personal loans can run from 1 to 7 years.

Thanks for helping me learn about different types of loans. I didn’t know that collateral for secured loans are things like savings accounts or homes. I’m interested to learn if the collateral can be a smaller asset or if it depends on the size of the loan.

Hi Taylor – It largely depends on the lender and the size of the loan. Some may accept other types of collateral.

Thanks for sharing this nice article. It was very useful for us.

My wife and I are considering taking out a loan to help pay off some of our credit card debt. It is interesting that you can borrow up to $50,000 in some cases without collateral with personal loans. We may consider looking online for a fast cash loan or something like that.

It is interesting that the bank will seize the home if you default on the loan. My wife and I are considering buying our first home now that we have a kid and need more space. We may consider reaching out to a few professionals to see what kind of home loan they recommend.