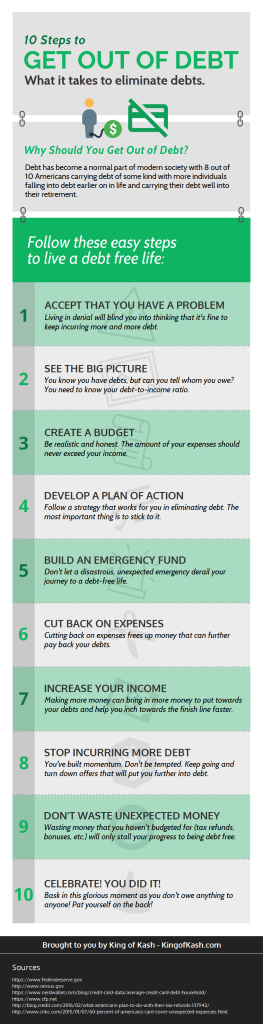

10 Steps to Get Out of Debt

Debt has become a normal part of the modern society. According to a report by Pew Charitable Trust, 8 out of 10 Americans carry debt of some type with mortgages being the most common.

Debt has become a normal part of the modern society. According to a report by Pew Charitable Trust, 8 out of 10 Americans carry debt of some type with mortgages being the most common.

What’s more alarming is that it isn’t just the younger generations who have debt. Many people are carrying their debt into their retirement without a plan to get out of debt in mind.

The Cost of Debt

According to the data from the US Federal Reserve and Census Bureau, along with the findings from NerdWallets’ survey, the average debt in American households is $130,992 which can be further broken down into the following:

- Mortgage: $168,614

- Student Loans: $48,172

- Auto Loans: $27,141

- Credit card: $15,762

Said study also revealed that Americans spend 9% of the average household income of $75,591 on debt interests. This means that $6,658 is spent each year by average households on paying off the interest of their debts.

Why can’t we get out of debt?

Interestingly, household income has increased by 26% for the last 12 years. So why then do we still deal with so much debt? Why can’t we get out of debt? What are people spending their money on? That is because the cost of living has increased by 29% for that same period of time. While we’ve been earning more, we’ve also been paying so much more on basic necessities like food, healthcare, and housing.

If you are one of the eight out ten Americans who carry debt, you definitely know how limiting having debts feels. Taking action to eliminate debt will help you create a more comfortable financial future as well as provide better financial security that seems so aloof for so many people nowadays.

How to Get Out of Debt in 10 Easy Steps

Acknowledge that you have a debt problem

Living in denial will blind you into thinking that it’s fine to keep incurring more debt. Establishing self-awareness about your debts will help you make more conscious decisions with your finances. The first step towards getting out of debt is to admit that you have a problem.

See the bigger picture

You know you have debts, but do you know who you owe? How much you owe? At what rates these debts grow? The second step is about seeing the bigger picture of your debt. Get a pen and paper (or open up spreadsheet on your computer) and write down all of your debts on one list. Under the first column, write the name of the debt (student loans, credit card debt, mortgage, personal loans, etc). In another column, write the corresponding amount of each debt. In the last column, indicate the interest rate.

It’s also good to see your debt-to-income ratio. On a clean piece of paper (or another black spreadsheet), write down your income in one column and the cost of your debt to another. This activity is quite eye-opening as you come face-to-face with your true amount of debt and how it eats a portion of your income.

Create a budget

A budget is a great tool to figure out where your money goes and it is indispensable in achieving better personal finances (not to mention eliminating debts). Unfortunately, according to the poll conducted by Gallup, only 32% of the Americans have prepared a budget and those who have incomes $75,000 and above & people with college degrees are more inclined to create and follow a budget.

If you don’t have a budget yet or the current one is not working to help you pay off debt, it’s time to create new budget that works for your needs and lifestyle. Sit down with a pen and paper and write out all of your expenses, including both recurring and non-recurring. Now, assign the cost for each expense. Don’t forget to place your debts and their costs as well. Adjust the cost based on your income and financial goals. Be realistic and honest. The amount of your expenses should never exceed the amount of your income.

Develop a plan of action

Follow a strategy that works for you in eliminating debt, whether tackling ones with higher interest first or those with the smallest amount first is easiest for you.

The first approach, also termed as laddering, allows you to pay off debts with the highest interest first while paying the minimum payment other low-interest debts. This approach makes mathematical sense because you’re losing the least amount of money from interest and keeps your debts from getting out of hand.

The second approach is called snowballing. In this method, you pay off debts with the smallest amount first regardless of the interest. It allows you to build momentum and become more motivated in tackling your bigger debts. This method has more psychological impact than mathematical, but it has helped a lot of people become debt-free too.

Regardless of the plan of action you take, the most important thing is to stick to it.

Build an emergency fund

You can easily be thrown off-track in your journey to a debt-free life if you’re just one step away from a disastrous emergency that you can’t solve financially. Having an emergency fund allows you to stay focused on your debt-elimination efforts without having to worry about the unexpected expenses.

Don’t be one of the 62% Americans that can’t handle unexpected expenses. According to a study commissioned by Bankrate, only 38% of the Americans are able to handle $500 – $1000 worth of emergencies (car repairs and minor medical emergencies for example); while 26% say that they will have to cut costs from their budgets to attend to an emergency. Meanwhile, 28% says that they would resort to borrowing from family or charging their credit cards.

If you don’t have an emergency fund or the current one is dwindling low, focus on building it up first while you take care of minimum payments on your debts in the meantime. Once you’ve beefed up that fund and you feel comfortable that you can face a financial emergency without compromising your debt payments, you can go on with your journey with renewed intensity and laser-focus.

Cut back on expenses

Cutting back on expenses further frees up money that can help further bring your debts down. Look over your budget once again and check where you might cut back and still live a comfortable life. Perhaps you can cut back on that gym membership you rarely use and opt for cheaper and free alternatives like running and biking. Try to negotiate a better and cheaper plan for your mobile phone or make the switch to a cheaper network. Cut back on cable if you’re already watching movies and TV shows in Netflix. Opt for cheaper dates, homemade meals, and zero-cost activities.

Increase your income

While cutting back on expenses can help you gain more money from the income you already have, you can only cut back so much. Increasing your income does bring in more potential to gain money that you can throw to debts.

There are numerous ways to increase your income. You can sell some of your things on e-bay or do a garage sale. If you feel like you already deserve it, approach your boss for a raise. You can also bring in more money by getting a second job or part-time job that you can do on you free time (tutoring, baby-sitting, dog-walking, freelance writing, blogging, and so much more). Don’t be afraid to wear several hats and make sacrifices if this means you will be inching towards the finish line more quickly.

Stop incurring more debt

You’ve built your momentum and you are excited to finally get away from debt. Now is not the time to get tempted. Right now, you just have to keep going and turn down offers that will potentially get you back on more debts. Decline expensive restaurant dates and offer to cook in your home instead. You don’t need a brand new car or bigger home right now — you need to get out of debt. Stop going to sales if you feel like swiping your credit card again. Whatever it is that is tempting you to get back in debt, stop right there and re-establish your focus.

Throw unexpected money towards paying off your debts

Apart from your main income and side jobs, you may still get some unexpected money like tax refunds, an inheritance, lottery winning, wedding gift etc. These are funds you may have not budgeted for so it’s easier to blow them on things that you deprived yourself of during this journey. That is perfectly understandable, but you need to think first.

According to a Bankrate study, 30% of the Americans receiving their tax refund intend to use it to pay down debts, while 28% intends to save or invest their refunds, and 26% says they will allocate the money for necessities. 7% admits that they will use the amount for fun like going on vacation.

Throwing that huge amount of money to debts will bring you closer to a debt-free life and you will have more freedom to afford these things afterwards. However, blowing unexpected money will only stall your progress.

Celebrate

You’ve done it! Now go ahead, open a cheap bottle of wine and bask in this glorious moment when you don’t owe anything to anyone. Pat yourself on the back.

It’s a good bet that eliminating your debt has not been easy for you. You worked hard and sacrificed a lot to get here, but doesn’t this feel rewarding? The next step is now to plan your debt-free life and live it according to your means, without any debt pulling your leg down.

Cary Silverman is a consummate entrepreneur having sold multiple companies during his 20 years of business experience in the financial industry, but for him, it isn’t about the money. His success is rooted in his passion to focus on doing something better today than it was done yesterday. These days, he’s the CEO of Waldo General, Inc. that oversees the operation of King of Kash.